London, England - January 31, 2005 - The new Strategy Analytics report, "Telematics Development in the Vehicle Insurance Market," reveals that Pay-As-You-Drive insurance will not translate into commercially viable, mainstream offerings in the next three years, despite the growing industry and consumer interest, and continued trials of this system.

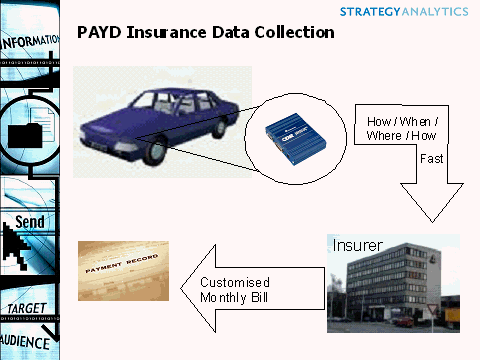

Pay-As-You-Drive insurance (PAYD) schemes enable variable vehicle insurance premiums to be based directly on how much, and in some cases how well, when and where, a vehicle is driven, using data collated by an Electronic Data Recorder (EDR), or `black box.' Across Europe and the US, a number of insurance companies have begun PAYD trials, including Norwich Union (UK), Progressive (US), Lloyd Adriatic (Italy) and AXA Insurance (Ireland). Information technology service provider, IBM, is involved in a number of trials across Europe and the US, and is very well positioned to take the lead as technology integrator.

Prohibitive launch costs, privacy violations, patent fees, "back office" data integration and difficulties in measuring the costs versus benefits will inhibit the immediate widespread launch of PAYD schemes. "While PAYD protects drivers from generalized assumptions, there are still major hurdles to overcome before PAYD insurance schemes are commercially viable; and these are not going to be successfully addressed for a number of years," says Clare Hughes, Analyst, Automotive Multimedia & Communications Service. "However, increasing government focus on road safety, the ability to verify insurance claims using tamper-proof vehicle data and the potential cost savings for insurance companies, commercial vehicle operators and the consumer, will drive the eventual introduction of commercial PAYD." Hughes continues, "The days of the once a year insurance premium will eventually disappear for the majority of consumers, with the rollout of risk-based variable monthly billing."

For a Pay-As-You-Drive Insurance Model, click here